Business Insurance in and around Amarillo

Calling all small business owners of Amarillo!

Helping insure small businesses since 1935

- Drippings Springs

- Kerrville, Tx

- Boerne

- San Antonio

Insure The Business You've Built.

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Rhonda Greathouse help you learn about terrific business insurance.

Calling all small business owners of Amarillo!

Helping insure small businesses since 1935

Cover Your Business Assets

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is temporarily closed. It not only protects your salary, but also helps with regular payroll expenditures. You can also include liability, which is key coverage protecting your company in the event of a claim or judgment against you by a customer.

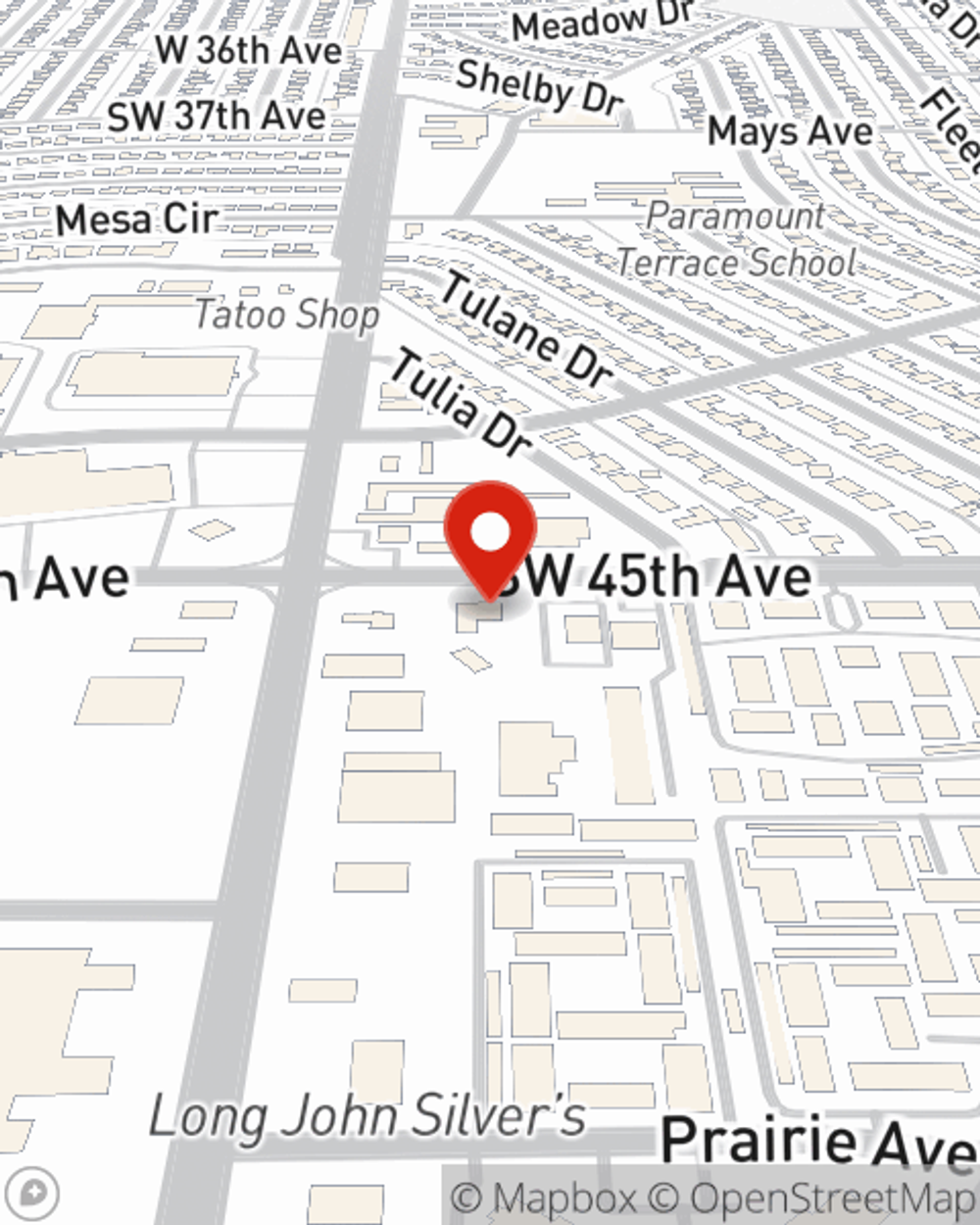

Get in touch with State Farm agent Rhonda Greathouse today to experience how the trusted name for small business insurance can safeguard your future here in Amarillo, TX.

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Rhonda Greathouse

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.